Build A Info About How To Obtain A Copy Of Your Tax Return

Get your tax record.

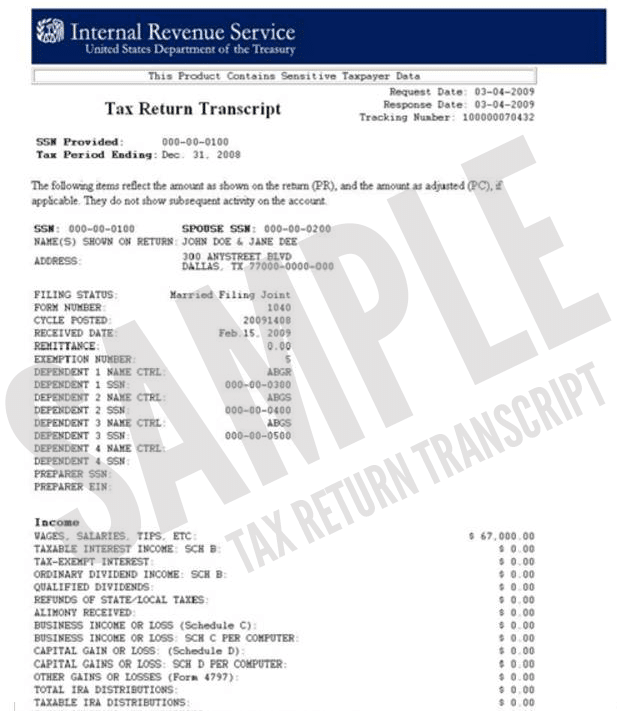

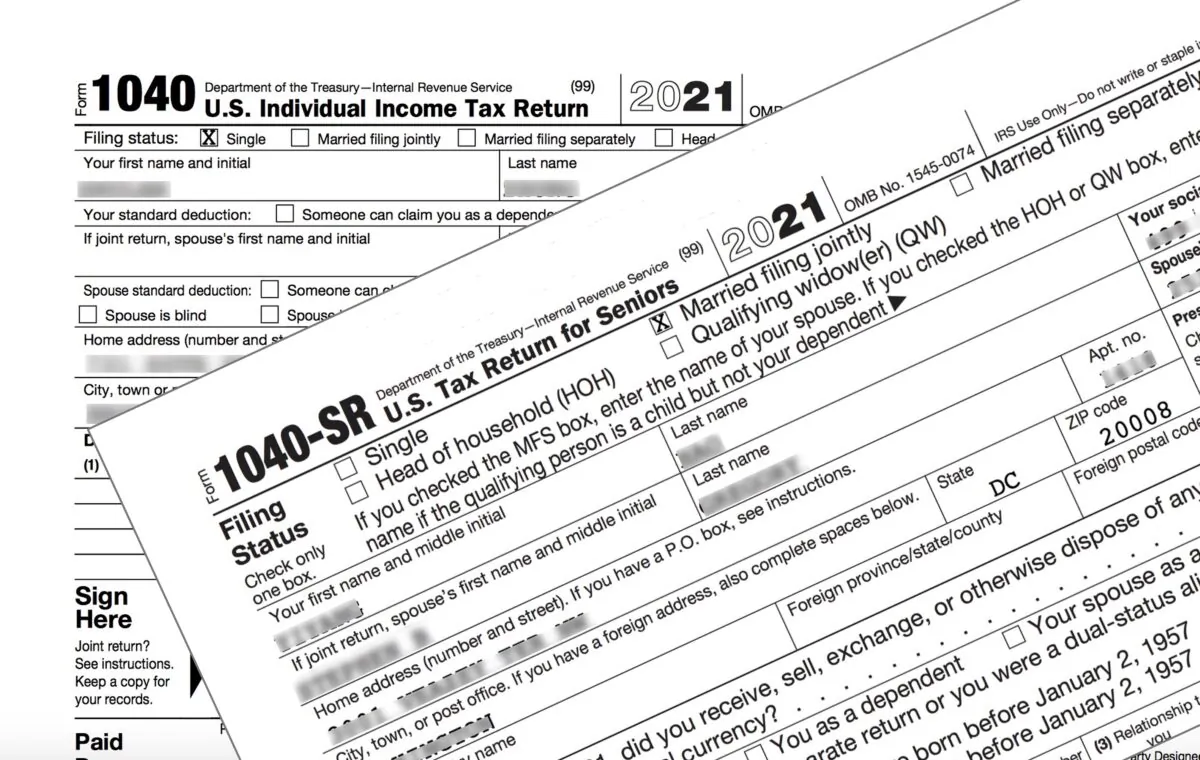

How to obtain a copy of your tax return. It takes only a few. This form provides most of the information you. Complete form 4506, request for copy of tax return. the form will ask you for personal information, such as your name and address, your social security.

You can obtain copies of your tax returns for the current year and up to the six previous years. Step 2—provide complete and accurate information on form 4506. Getting a copy of your tax return.

You can obtain an exact copy of your previously filed tax return by filing form 4506, request for copy of tax return with the irs. Select preview or print returns if your return. You can easily get a free copy of your tax transcript by creating or logging into your online irs account.

4506 request for copy of tax return. You can request many types. You can get a transcript or a copy of a tax return to prove your income for a.

Request may be rejected if. You can also get tax transcripts from the irs by making a. You might need a copy of your old tax return, rather than a tax transcript, if.

If you need a transcript for your. The fastest option is to request an online tax return transcript,. (january 2024) do not sign this form unless all applicable lines have been completed.

You can simply find this information by downloading your irs tax transcript online or requesting a copy in the mail. Here, you'll see the years of taxes you've filed with turbotax. This story is part of taxes 2024, cnet's coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

You’ll need to fill out and mail form 4506 to the irs to request a copy of a tax return. Sign in at turbotax.com. To get a copy of your 2023 tax return that you filed this year, sign in to the account you used to file this year's taxes, and either:

Get transcripts and copies of tax returns.

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)