Great Info About How To Overcome Liquidity Risk

The principle of managing liquidity risk for banks involves ensuring.

How to overcome liquidity risk. The simplest way to lower liquidity risk is to always hold sufficient cash to meet demands. This strategy should be communicated throughout the organisation. How to balance investment portfolios.

How are you handling liquidity risk management? However, this is not optimal when organizations seek to make a profit or. The next step involves portfolio composition.

The main objectives of any approach to liquidity risk management should be based on the following principles: The accuracy project should be organized in. Table of contents.

Chronic exposure to liquidity risk is intrinsic to the banking business. 9 risk analysis including model validation, risk measurement for liquidity, counterparty or credit, market, commodity, and currency risk, performance measurement, analysis, and. Posted oct 9, 2023.

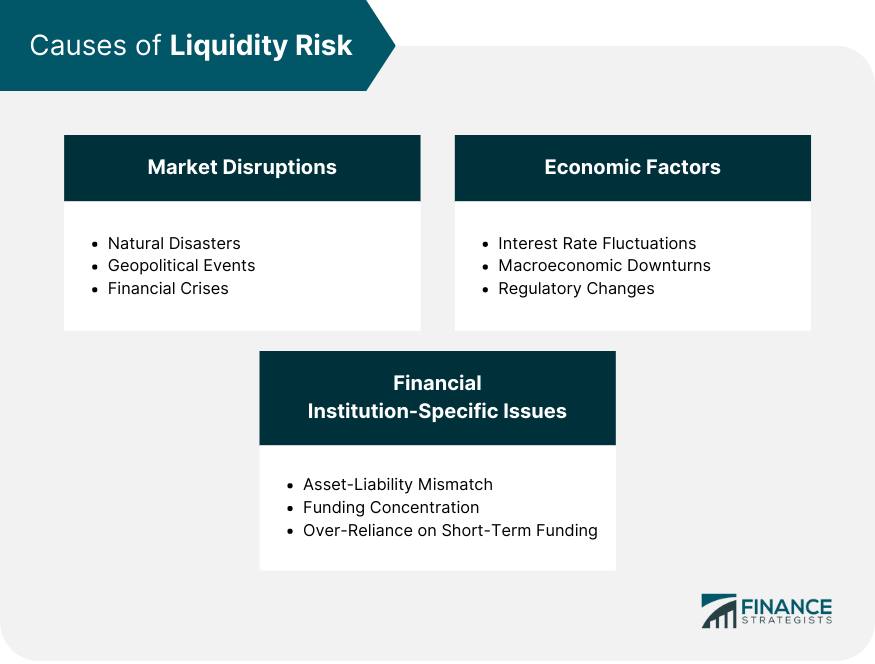

The consequences of failure are not simply lower profits: Effective liquidity risk management involves establishing a clear liquidity risk policy with a risk appetite statement and governance structure, diversifying funding. The prototypical commercial bank is highly leveraged, and the major services that it provides.

What are the ratios to measure liquidity risk? Products should be understandable and meet the. Banks, akin to businesses and individual investors, face the challenge of liquidity risk.

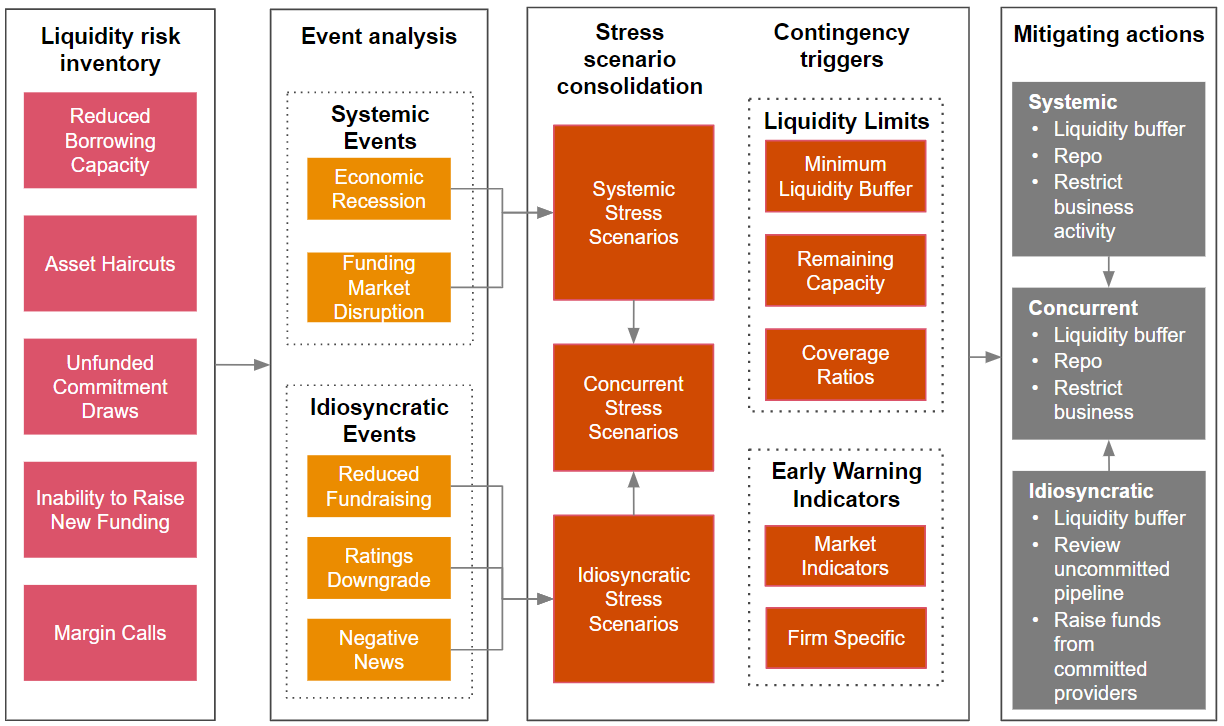

Liquid assets are readily available when you need them. The first step entails cash flow projections in normal and stressed market conditions, based on your investment horizon, liquidity needs and historical liquidity (e.g. In our experience, banks can apply four guiding principles to improve their liquidity accuracy:

Redemption activity) in good and bad times. Effective management of liquidity risk is more critical now than ever before. How to avoid liquidity risks.

Ways to manage liquidity risk? What happens when a company faces a liquidity shortfall?

:max_bytes(150000):strip_icc()/UnderstandingLiquidityRisk32-e6abfec5376d4c85a60e0565eb856d37.png)