Fine Beautiful Tips About How To Buy Calls And Puts

If you’re considering options trading, a great starting point is learning the difference between calls and puts.

How to buy calls and puts. You find a stock (or etf) you would like to buy. Brown fact checked by mrinalini krishna in this article view all difference between call options and put options example: It involves the simultaneous purchase of a bullish call.

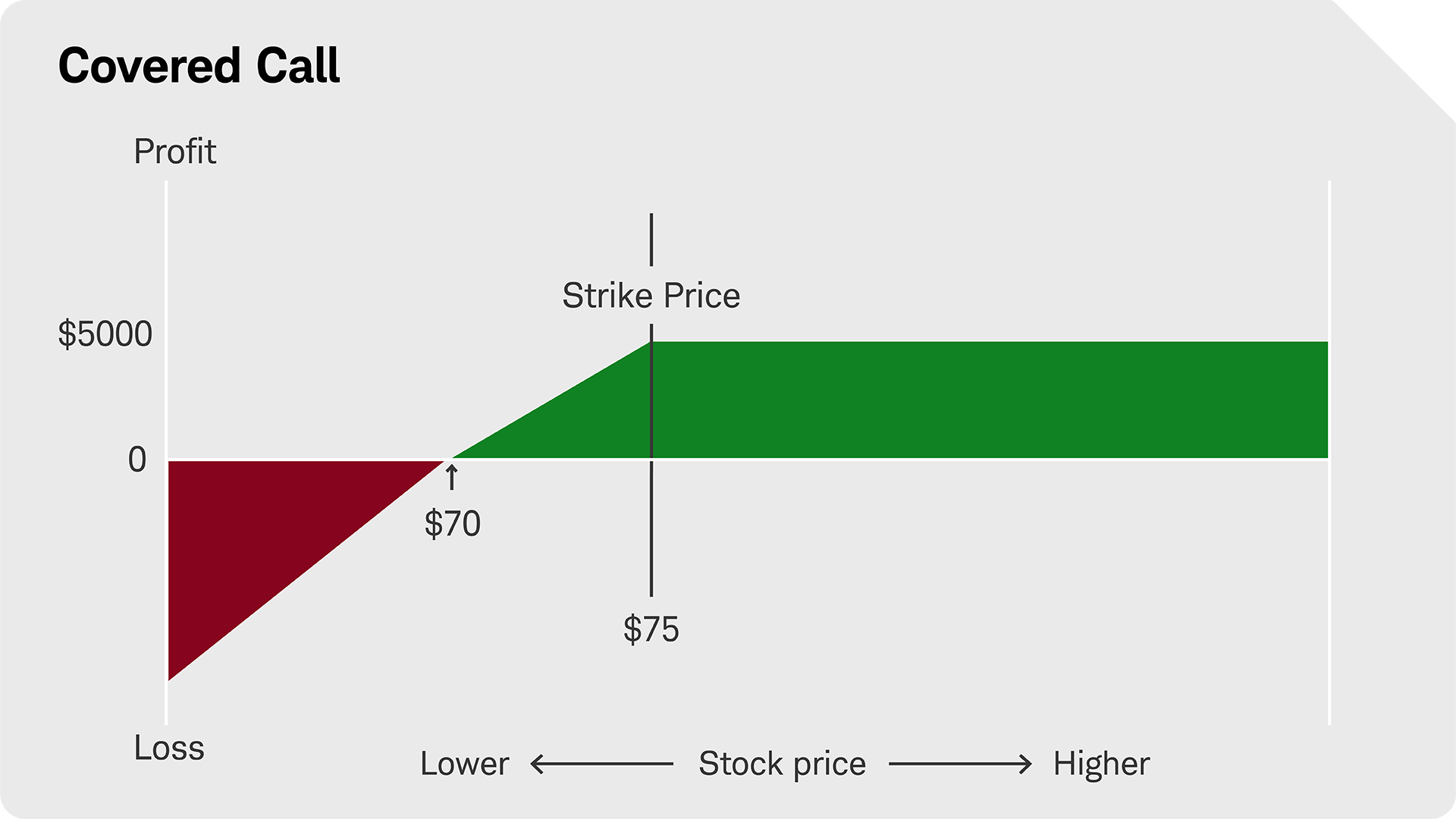

With this information, a trader would go into his or her brokerage account, select a security and go to an options chain. Learn / what is an option? Shortly before the call options expire, suppose xyz is trading at $103 and the calls are trading at $8, at which point the investor sells the calls.

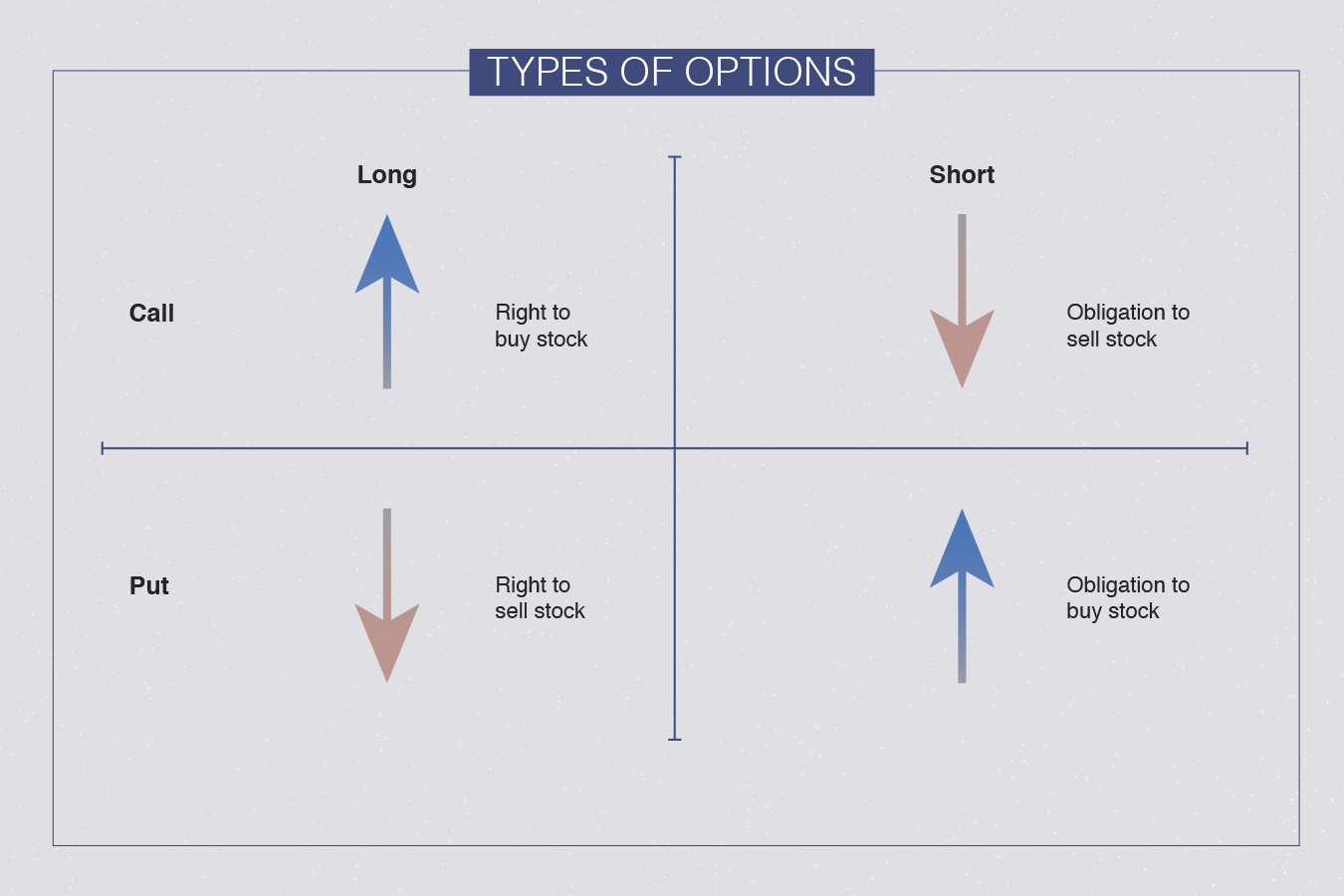

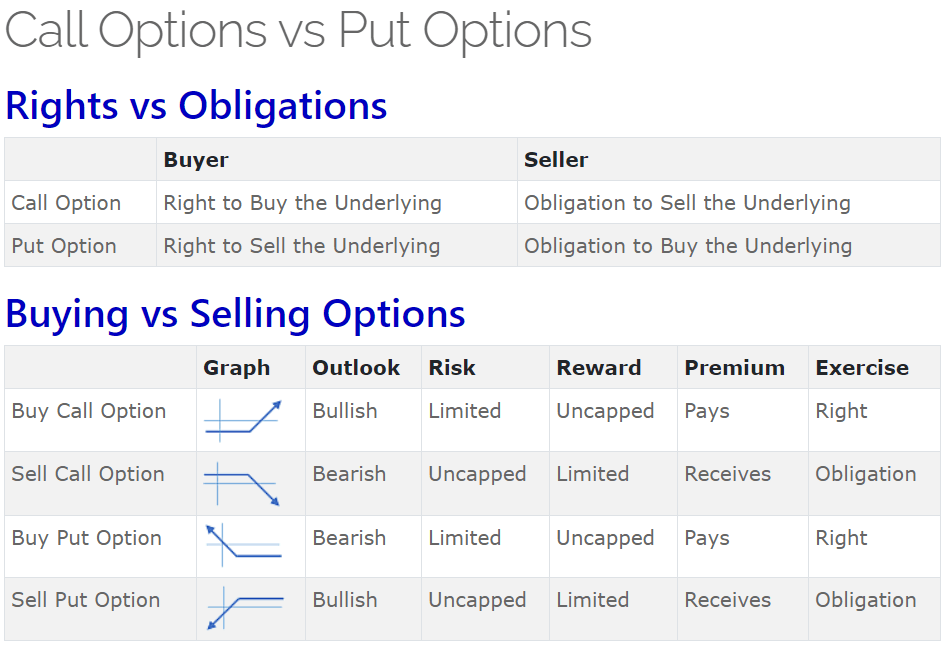

Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price specified in the option contract. The two varieties of options, calls and puts, can be combined in several different ways to anticipate the increases or decreases in the market, decrease the cost. When you buy a call, you pay the option premium in exchange for the right to buy shares at a fixed price (strike price) on or before a certain date (expiration date).

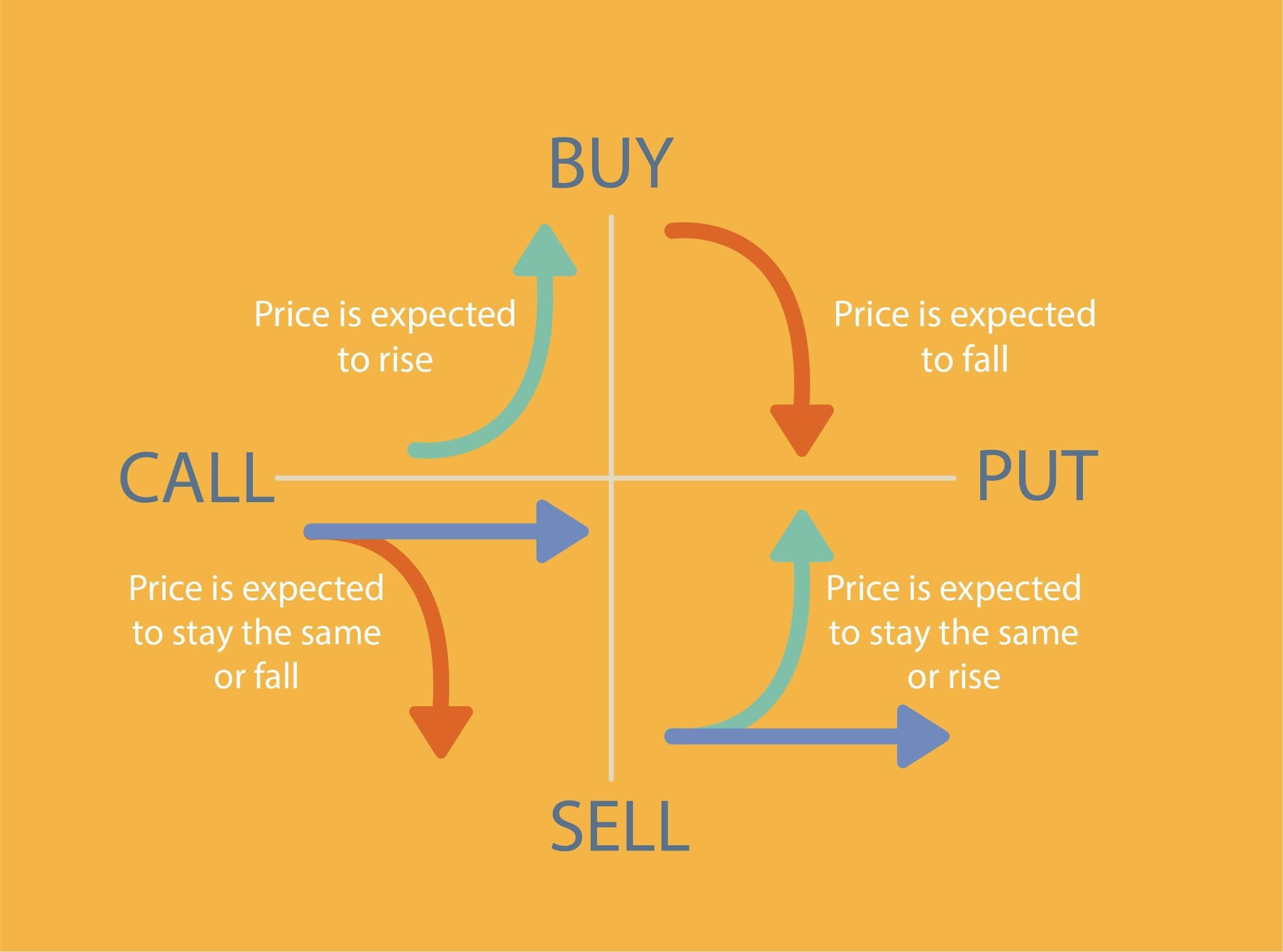

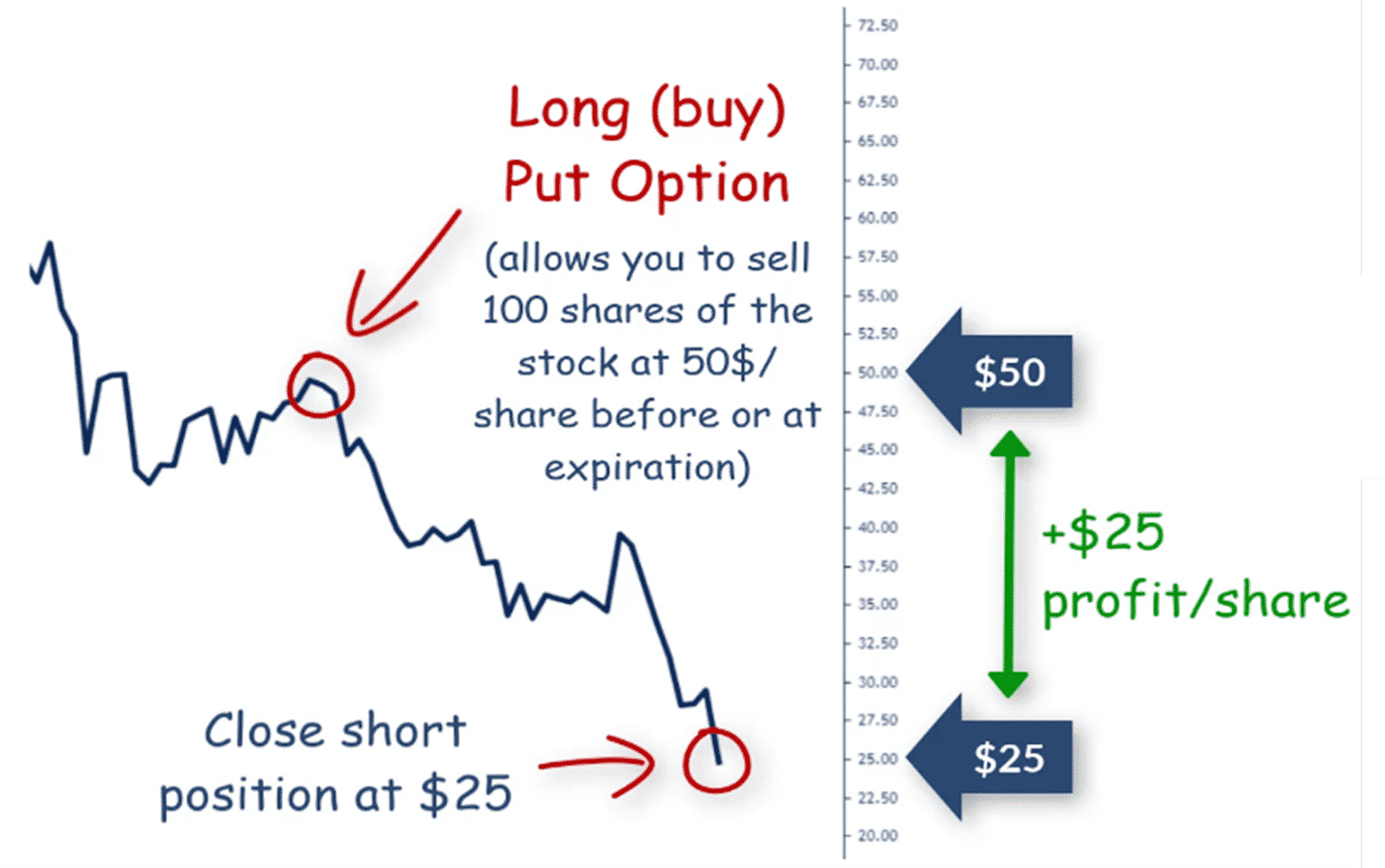

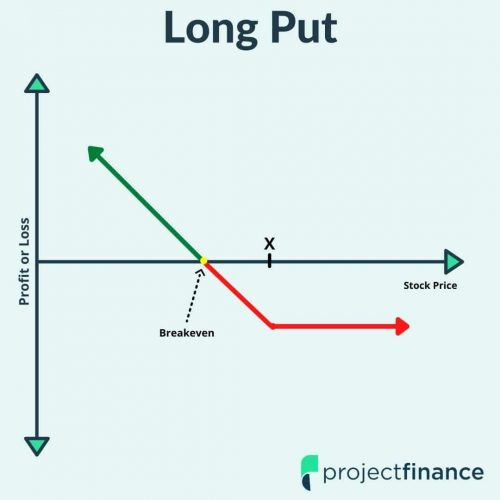

/ getting started with calls and puts getting started with calls and puts options trading comes with its own lingo, which can be confusing for some. Buying calls and puts is one of the simplest ways to take advantage of the perks of options trading. When you buy a put, you’re reserving the right to sell shares at, hopefully, a higher price than they are trading at.

Buying a call: Very simply, a call is the right to buy, a put is the right to sell. Know when it might be better to use call options.

Both types of options, of course, come with two parameters. When you buy a call, you make a small payment, or the “premium,” in exchange for the right to purchase the underlying stock at a set price, or the “strike. A beginner options strategy call options grant you the right to control stock at a fraction of the full price.

Buying options allows traders to capitalize on the true power of. Puts work on the other end of the spectrum. Investors most often buy calls when they are bullish on a stock or other security because it offers leverage.

When you buy a put option, you pay a premium to have the right — without being obligated — to sell the underlying stock at a predetermined price (strike. Instead of buying shares of the stock, you buy a call option, giving you the right to buy the stock at a lower or equal price for a. The expiration month*.

You have an obligation to deliver the security at a predetermined price to. Investors buy calls when they. Dive into the four most commonly used strategies by options traders to get a deeper understanding of how it all.

All options trades begin and end with calls or puts. Option intrinsic value = difference between market price of underlying security and option strike price (for put option, iv = strike price minus market price of. For example, assume abc co.

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

![[WIP] Enrollment Options Trading Program Beyond Insights](https://www.beyondinsights.net/wp-content/uploads/Call-vs-Put-Options-1536x830.png)