Divine Info About How To Become A Tax Return Preparer

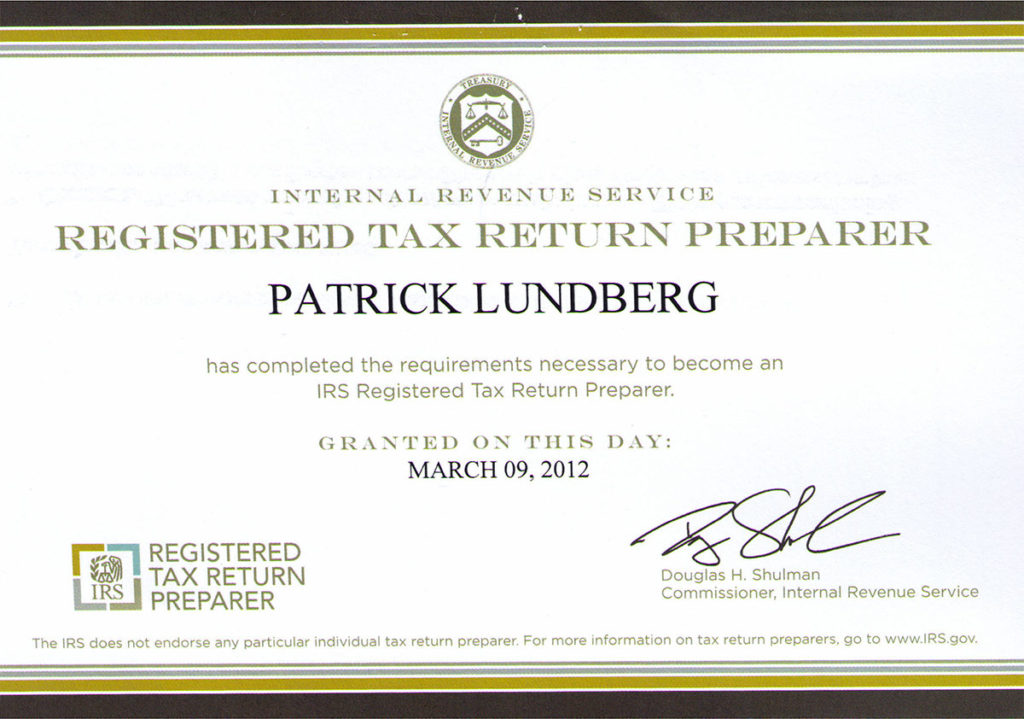

Any tax professional with an irs preparer tax identification number (ptin) is authorized to prepare federal tax returns.

How to become a tax return preparer. A tax preparer handles the taxes for individuals, organizations, companies, or governments. Accreditation, pricing, and more drake software blog team monday, january 15, 2024 so you’re thinking about becoming a. Complete your education a high school diploma or ged is the minimum.

How to become a tax preparer: How to become a professional tax preparer getting started as a professional tax return preparer may be easier than you thought. Find out how to become a tax preparer in 2020 with this career guide.

Complete high school earning a high school diploma or a general educational development (ged) test is the first step to becoming a tax preparer. Next, you will need access to tax preparation software. Namely… what does a tax preparer do?

Figuring out how to become a tax preparer requires deciding between a few paths: Learn what it will take to become a tax preparer in 2024. Learn more about what you need to get started.

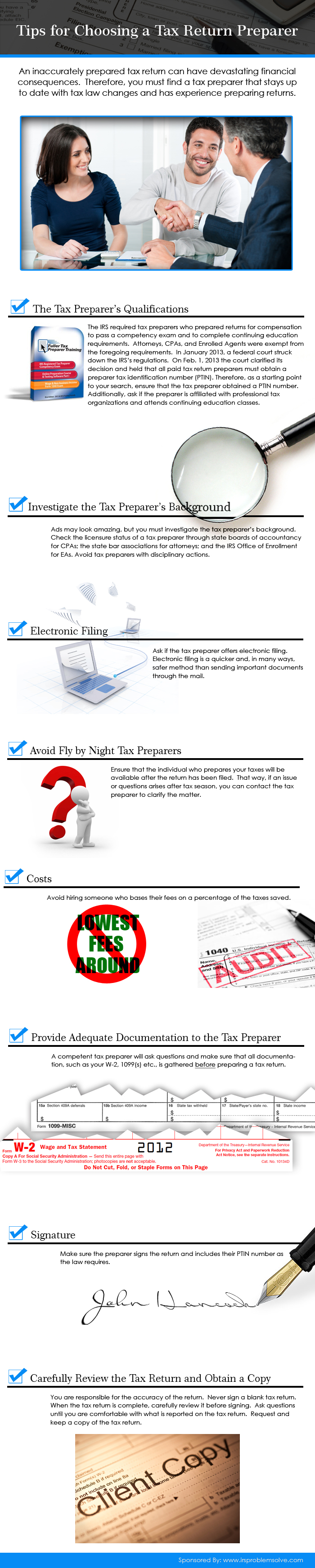

Frequently asked questions enrolled agents annual filing season program participants enrolled retirement plan. Requirements for tax return preparers: Here’s what tax preparers charge, on average, by fee method:

Tax preparers calculate, file, and assist individuals and businesses with simple and complex tax returns. Anyone paid to help you with your federal tax return has to have. If you're interested in becoming a tax preparer, here are some steps to follow:

A tax preparer is an individual who prepares, calculates, and files income tax returns on behalf of individuals and businesses. They serve as knowledgeable resources in tax. Anyone can be a paid tax return preparer as long as they have an irs preparer tax identification number (ptin).

Minimum fee, plus complexity fee: This course involves learning the ins and outs of preparing taxes and tax laws. Helping clients save money when it comes time to file taxes.

What is a tax preparer? You can become a tax preparer by registering with the internal revenue service,. A ghost preparer is someone you paid to handle your return who doesn’t sign it.

First, you will need to take a course to receive certification. You may do so through a company or by purchasing the software. A tax preparer is a financial professional who specializes in preparing and filing income tax returns for individuals and businesses.