Painstaking Lessons Of Tips About How To Increase Withholding

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help.

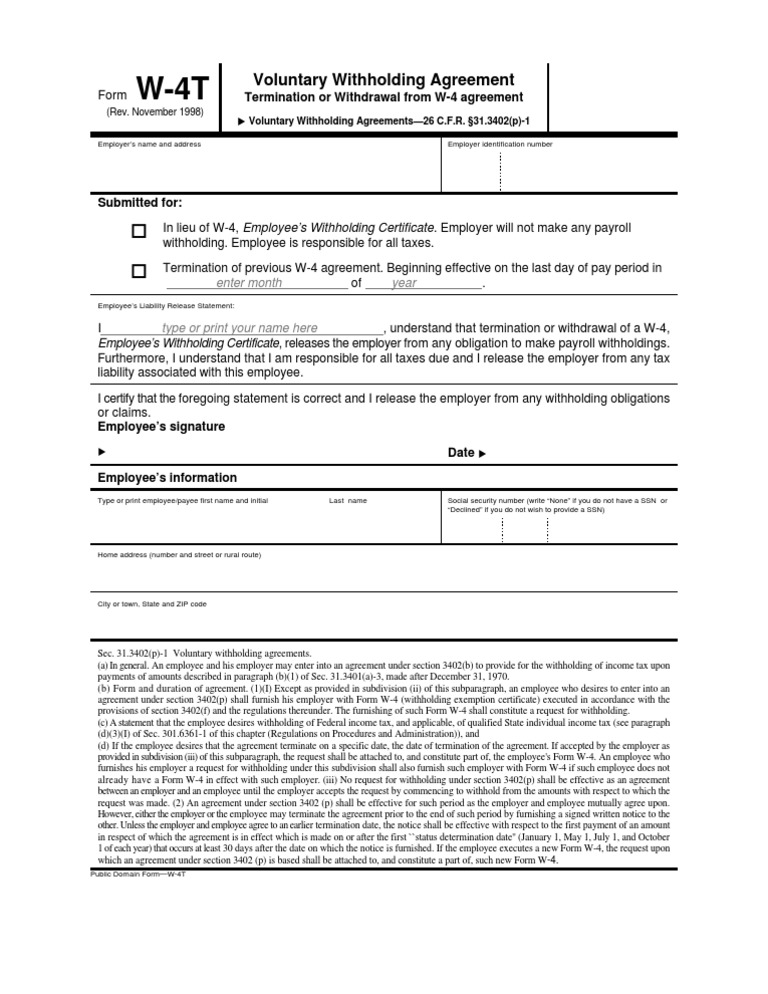

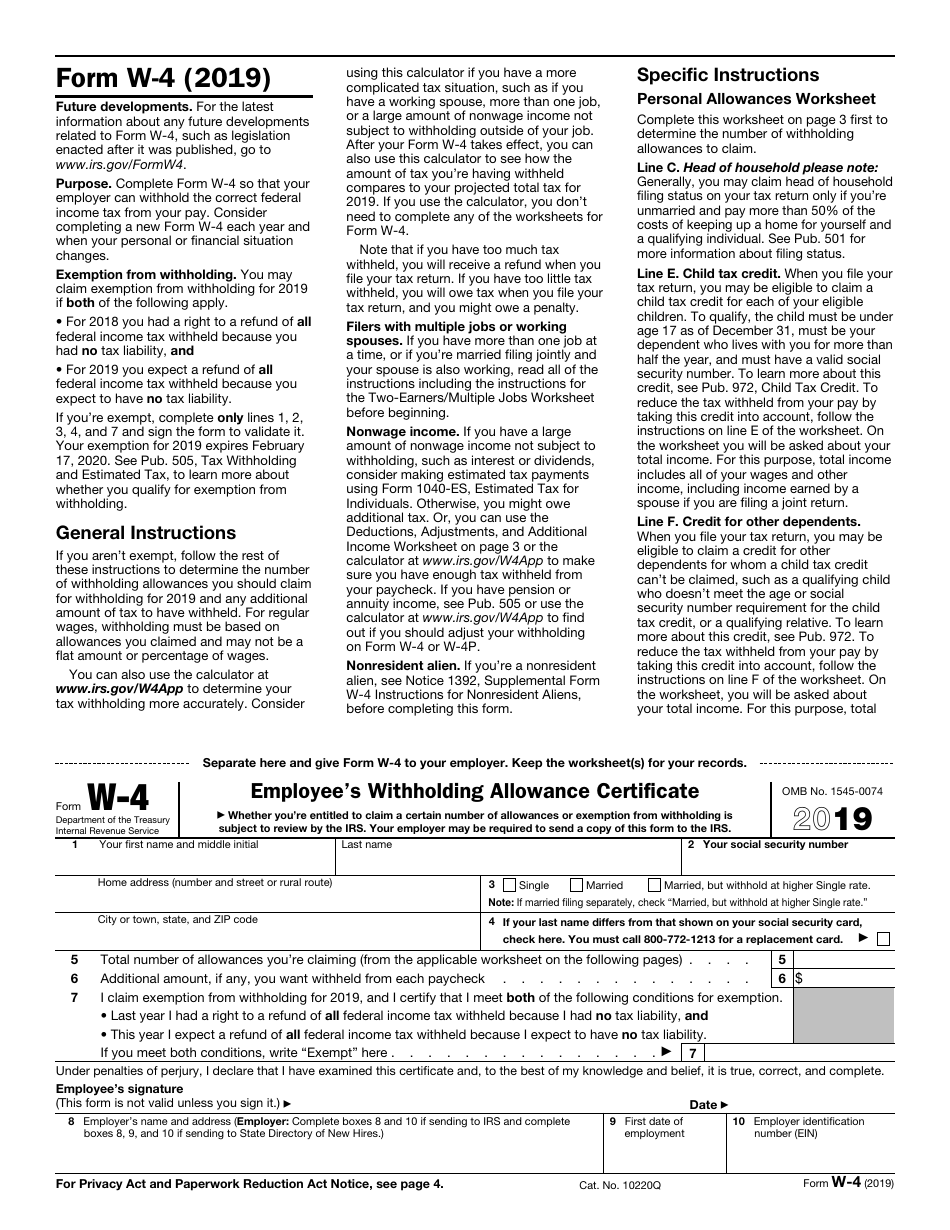

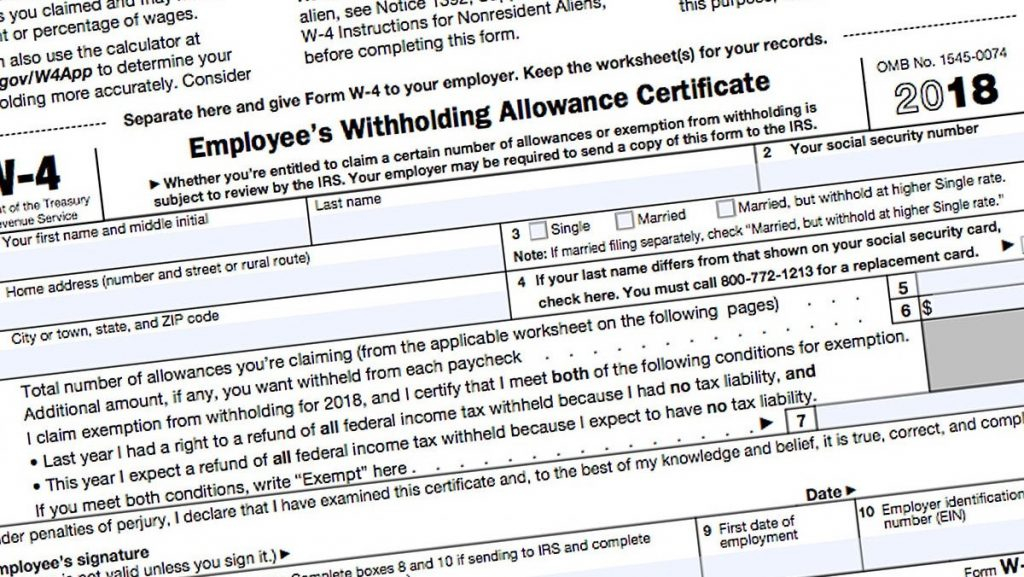

How to increase withholding. Line 4 (a) increases the amount of income subject to withholding line 4 (b) decreases the amount of income subject to withholding to ensure that you get the best. The simplest way to figure out how much should be exiting your paycheck each month is the irs’ tax withholding calculator. Ohio revised code section 5747.07(h) requires that the employer’s successor withhold enough purchase money to cover the amount of the taxes, interest and penalties due.

Use the irs withholding calculator tool. First, if your spouse earns an income, your overall household withholding may need to increase. How to change your tax withholding.

A great way to manage down labor costs while adding flexible skills and capacity to your team is offshoring or outsourcing certain roles. It tells the employer how much to withhold from an employee’s. The payer may include people who are residents of another country on an.

Adjust your additional withholding amount if needed. Washington — the internal revenue service today urged taxpayers to check their tax withholding while there's time left in 2022 to benefit from any necessary. You can choose to have a lot of money taken out each week or you can choose to have a smaller amount of money taken out each pay period.

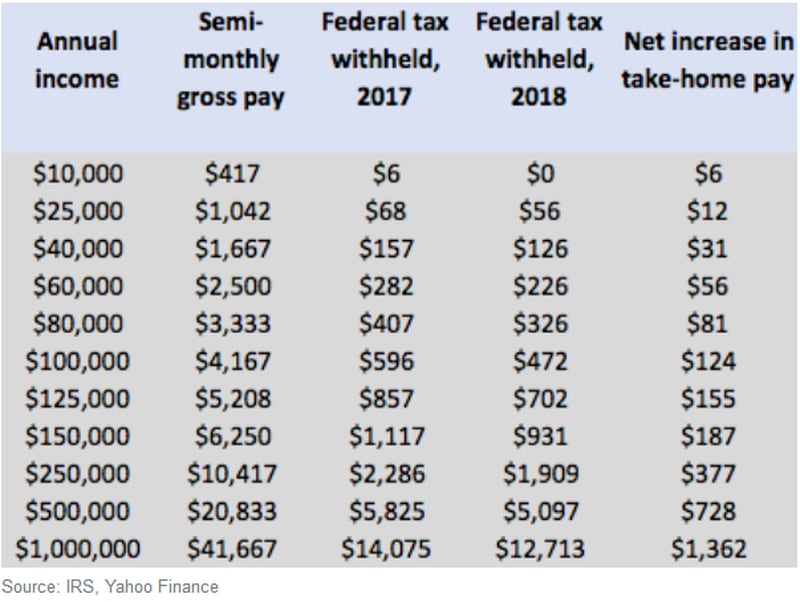

You can withhold more money from your paycheck if you want a bigger refund by entering an amount in box 4 (c). You may use the results from the tax withholding estimator. Withholding tax is a portion of federal income tax that an employer withholds from an employee’s paycheck.

Second, if your spouse doesn't work, your overall withholding.